We will discuss Recurring transactions in a separate article. But if you're entering an expense to pay at some future date then the Bill would be the correct transaction type. That is not necessary as you would just write the check straight away. If you are writing the check immediately you do not want to enter a bill and then pay the bill. You want to use this function when a vendor has given you terms such as Net 30. The third way to enter a transaction in this instruction is by entering a bill. Of course you can always add additional information in the Memo section if desired. If you choose to print the check immediately you just choose the Print check button. The Print later option is typically used if you print multiple checks in a batch like a weekly check run. In the example below you can see on the far right you can put the check number or check the box to Print later. Expense is the value of resources used to produce income. Income is the value of products and services produced by the business. In the case of the expense transaction we could put debit or eft or some other meaningful reference. Why Track Income and Expense Your chart of accounts must include the individual sources of income and expense that you are interested in tracking either for income tax purposes or for management and control purposes. First of course you include the check number. Ask questions, get answers, and join our large community of QuickBooks users. Writing a check is virtually the same with some subtle differences. Enter Personal Expenses: Paying with Company Funds. The description is optional but is always a good idea to complete this if possible.Īfter the expense has been saved the balance in the checking account is reduced by $150. The appropriate vendor and account have been chosen as well as the appropriate bank account.

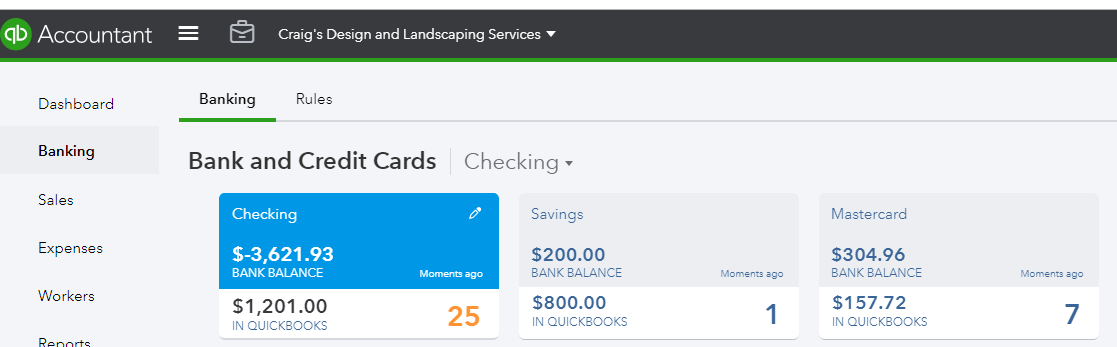

As you can see below you see the balance in your checking account prior to the expense of $1,201. We'll assume we're using our debit card to pay for some much needed computer repairs. In our first example we'll show you the use of the Expense option. Regardless, the important thing is this will keep your Vendor history intact for future reference. In the desktop versions we used checks regardless if it was a real check or a debit transaction such as an EFT or just the general use of your debit card. QuickBooks Online is merely trying to help you choose the option that is most appropriate. In the Jim sells widgets to Biff example, if Biff correctly records the invoice for the widgets and. Whether you enter an expense via the Expense option or the Check option the accounting behind the scenes is identical. Additionally, QuickBooks also uses the information it collects through the Enter Bills and Pay Bills commands to record expense amounts under the correct date for both the accrual and cash basis financial statements the program produces.

#ENTERING PERSONAL EXPENSES IN QUICKBOOKS PRO#

This Expense option is not available in the desktop versions of QuickBooks Pro or Premier. Under the Vendors menu you can see the various choices such as Expense, Check & Bill.

From the Home Page you click on the + sign to bring up the transaction menu. Reference no = Employee's abbreviated name and expense report submission date (ex.Entering expenses in QuickBooks Online (QBO) is easy. Payment date = Expense report submission date Payment account = Petty cash account or Clearing account To record the expense transactions, we are going to do a zero-sum transaction using an expense form instead of a journal entry.Ĭlick the Quick Create (+) icon, select Expense, or Check under the Vendors columnĮnter the same vendor's name (aka your employee) from the prior step Record the Expense to Reduce The Employee Cash Advance Account Balanceįor this process, you will need a copy of the expense report from the employee and need to use the petty cash or clearing account we created above. PRO TIP: Don't forget to remind your employee to submit an expense report with supporting documentation for how the cash was spent.

0 kommentar(er)

0 kommentar(er)